McHenry County voters soon could decide whether to sign off on a sales tax increase.

The McHenry County Board this week discussed but did not vote on placing a referendum on the ballot for a proposed 0.25% retail sales tax increase that would change how the McHenry County Mental Health Board is funded.

If the County Board approves the plan Tuesday, the question then would go to voters on the March 19 primary election ballot.

County Board members – many of whom also will be up for reelection on the same ballot – had varying opinions on the proposal.

Board member Theresa Meshes, D-Fox River Grove, had concerns with the timing of the ballot, among other things. She said she supported putting the measure on the November general election ballot.

“I’m not convinced this is ... a better way to tax over property tax,” Meshes said.

The McHenry County Mental Health Board has thrown its support behind the proposal – which would shift much of the board’s funding from property taxes to the sales tax.

Some members, however, have concerns that the switch to a sales tax model would prevent the board from funding developmental disability services they help to fund.

Board member Michael Skala, R-Huntley, brought up concerns about the backstop.

“I want to make sure government can’t go back and double tax me in the future,” Skala said.

Board member Terri Greeno, R-Crystal Lake, asked whether officials would make sure people knew the tax wouldn’t apply to food or medicine and also wanted to avoid double taxing, mentioning the gas tax increase the board enacted in September and subsequent property tax levy increase.

“We want to make absolutely certain that the mental health board has the funding that it needs and doesn’t also have a levy tax on top of it,” Greeno said.

Board member Lou Ness, D-Woodstock, agreed with Meshes that it was too soon to put the referendum out. Ness said she supports the tax but stressed that educating voters is “important.”

“This money would really only stabilize existing services,” Ness said.

County Board Chairman Mike Buehler, R-Crystal Lake, called the sales tax proposal a “win-win for everybody.”

“We owe it to the taxpayers to have a significant reduction in the county’s portion of the property tax,” Buehler said.

According to proposed language included in county documents, the ballot question would make clear that the levy for the mental health board would go away if the sales tax increase passes.

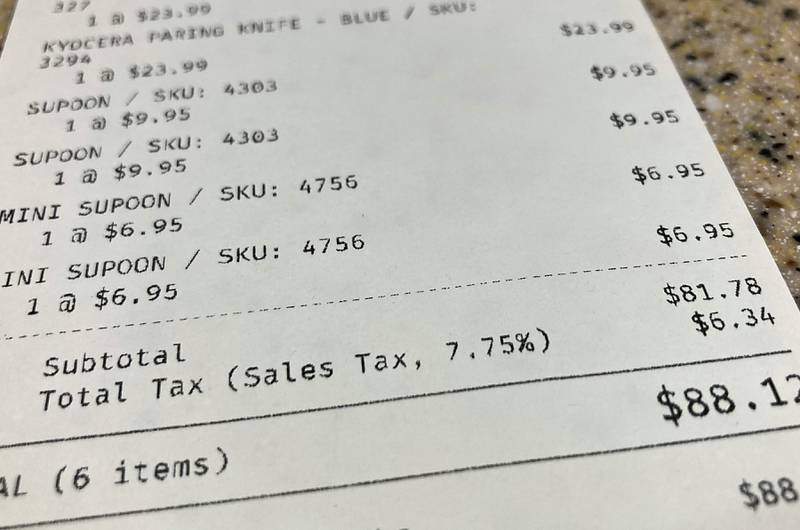

The proposed ballot wording also outlines how much a consumer would pay in tax, saying for every $100 of retail spending, the extra tax would be 25 cents.

In Crystal Lake, where the existing total sales tax is 7.75%, the new sales tax would be 8% if the referendum goes in front of voters and passes.

The County Board will vote on it Tuesday night. If the referendum is approved, the increased sales tax would kick in July 1.